“Dominica has long been in the forefront of ecotourism.” – Everett Porter (National Geographic)

Named the Nature Island for its unspoiled tropical beauty, Dominica is arguably one of the most breathtaking islands in the Caribbean, boasting one of the best standards of living in the region.

What makes it special?

Commonly known as The Nature Island, Dominica rises up from the languid waters of the Caribbean to serve as a beacon for world revellers and travellers seeking solace in a place that time has forgotten. One of the best-kept secrets of the Caribbean, the country is a verdant tapestry of lush rainforests, majestic mountains, gushing rivers, wild waterfalls, and volcanic wonders. It has everything you need to rejuvenate your mind and body.

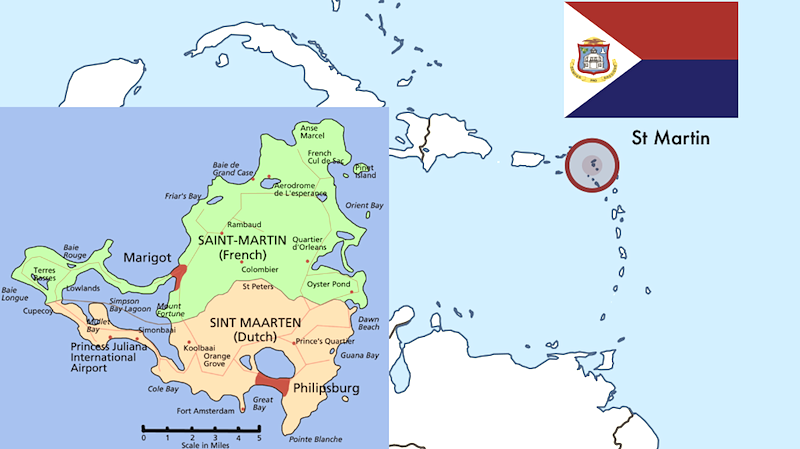

Resting in the heart of the Eastern Caribbean archipelago between Martinique and Guadeloupe, it’s known officially as Commonwealth of Dominica. Which is about as official as things get on The Nature Island.

Whether you’re looking for a rugged day of hiking, a enthralling day of diving, or just a lazy afternoon relaxing on a veranda surrounded by the sounds of birds flying over the crashing waves, wind through leaves, and scenes unfound anywhere else, Dominica, and its people, await you with open arms.

Key Facts:

Climate – tropical; moderated by northeast trade winds; heavy rainfall

Population (2018) – 71,625

GDP (Per Capita) (2018) – $6,860

Official language – English

Major religions – Christianity (94.4%), Folk Religions (3%)

Ethnic Groups – Black (African) (86.6%), Multiracial (9.1%), Island Caribs (2.9%), European (1.3%)

Government – parliamentary republic

Currency – East Caribbean Dollar (XCD)

Tax – An individual is considered a resident if he/she is physically present in Dominica for at least 183 days in a calendar year. Resident individuals are taxed on their worldwide income. Non-resident individuals are taxed on income derived or sourced in Dominica. Taxable income includes income from business, employment, rent, royalties, interest, discounts, premiums, commissions, fees, etc., less allowable deductions and allowances. The rate is 15% on the first XCD 20,000 of income; 25% on the next XCD 30,000; and 35% on the excess. There is no capital gains tax.

Residency by Investment:

In order to gain permamnent residency in Dominica, you must have renewed your one-year temporary residency permit annually for five years. Otherwise, you can have worked on the island for five years. Application of permanent residency must be submitted through the Ministry of Foreign Affairs, Immigration, and Labor.

Citizenship by Investment:

Investment Options:

Option 1 – Government Fund Donation:

- Single Applicant – A single applicant is required to make a nonrefundable contribution of US$100,000 to the Government Fund.

- Family Application I (Applicant + spouse) – A nonrefundable contribution of US$175,000 qualifies the main applicant and the applicant’s spouse.

- Family Application II (Applicant + up to three qualifying dependents) – A nonrefundable contribution of US$200,000 qualifies the main applicant and up to three dependents. An additional $25,000 is required for each additional dependent, other than a spouse.

Option 2 – Real Estate Investment:

Applicants may purchase property valued at a minimum of US$200,000 in a government-approved real estate development. The investment must be maintained for a minimum of three years. If maintained and sold after five years, the property qualifies the next applicant for citizenship as well.

Nationals of the following countries and territories will be treated on a case-by-case basis: Afghanistan, Chechnya, Iraq, North Korea, Pakistan, Sao Tome Principe, Saudi Arabia, Somalia, Sudan, Turkmenistan, Uzbekistan and Yemen.

Exceptions are applicants who have been legal residents in other countries for 10 years or more and whose investment funds do not originate from one of the above-mentioned countries.

Why it makes sense?

- There are no physical residency requirements.

- Inclusion of dependent children under 30.

- Inclusion of unmarried daughters under 30 living with and fully supported by the main applicant.

- Inclusion of dependent parents and grandparents over 55.

- There is no education or managerial experience required.

- Visa-free travel to over 125 countries, including Europe’s Schengen zone, the U.K., Hong Kong, Malaysia, Singapore and Turkey.

- No taxes for nonresidents.

To request the most current information regarding this program please contact us below.

To get more information & assistance, please submit the form below and our specialist will get in touch with you at the earliest.